Lexemo wants to bring clarity into the complexity of the constantly changing financial markets regulation and make regulation more accessible and transparent. CARA, the first product of Lexemo, which recently started with a ‘pilot beta test’, is an online subscription service for the European Capital Requirements Regulation (CRR) suitable for single users, teams and large financial institutions.

LTB: Pascal Di Prima, thank you for answering us some questions about Lexemo und your product CARA. What does Lexemo do?

Pascal Di Prima: We are all about the visualisation of complex legal texts and frameworks. Our mission is to bring clarity into the complexity of the constantly changing financial markets regulation. The idea behind Lexemo is to make regulation more accessible and transparent.

LTB: Who are the founders and key-team-members?

LTB: Who are the founders and key-team-members?

Pascal Di Prima: We are three founders at Lexemo, which are Olaf Draeger, Marco Di Prima and myself. Olaf is our CTO, with more than 20 years of experience in implementing and managing IT infrastructure and IT teams in the Banking and Hedge Fund Industry. Marco is CFO and before Lexemo he was building and leading several teams as Managing Director at JPMorgan, Lehman Brothers and Mediobanca in Equity Capital Markets and Corporate Equity Derivatives advising European Financial Institutions and corporates clients. I’m the CEO and a German qualified lawyer. Before founding Lexemo I was a banking regulatory Partner at Simmons & Simmons and Counsel at Clifford Chance advising European Financial Institutions on EU banking regulation.

LTB: What are the key features of your research platform CARA?

Pascal Di Prima: CARA is our first product. It is an online subscription service for the European Capital Requirements Regulation (CRR) suitable for single users, teams and large financial institutions.

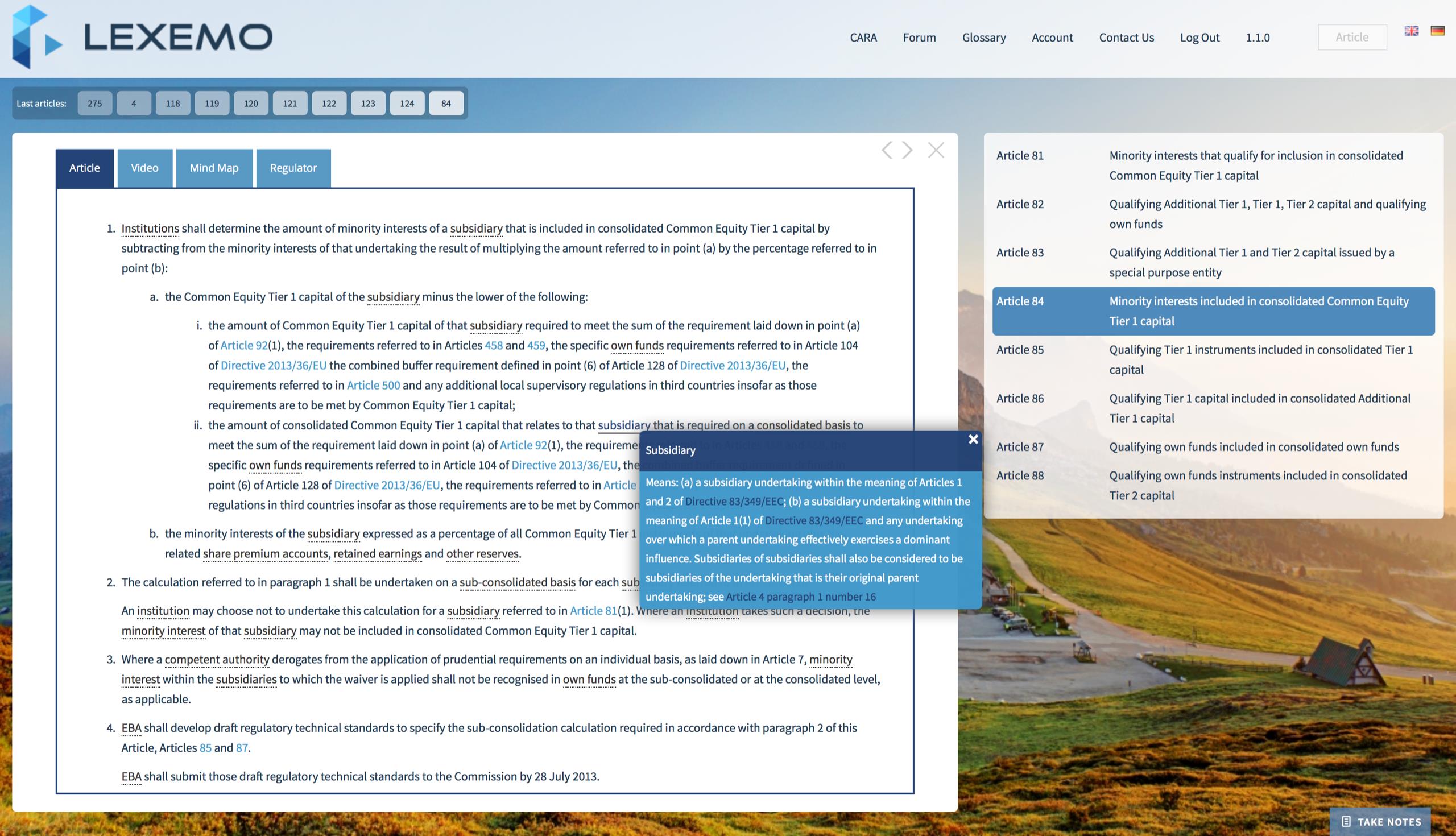

CARA provides an easy visual navigation through the hierarchy of the CRR with intelligent search, with instant access to all legal definitions and all relevant ECB and EBA publications, which are directly linked to each article. Our beta tester value the speed of this visual workflow and the time savings. The core value of the subscription are the constantly updated short and concise video tutorials and mind maps which are available for more than 450 articles of the regulation. These videos give professionals, who are not intimate familiar with the CRR, access to a current online commentary which can answer many questions.

This service is available in English and German and can be individualised with personal notes and knowledge can be shared within team specific forums. We will also provide CRR certification courses.

With CARA the line between training platform and expert knowledge databases is blurred, because CARA can be both.

LTB: What stage is CARA currently at?

Pascal Di Prima: We recently announced the start of the ‘pilot beta test’ of CARA. Our pilot clients are Helaba Landesbank Hessen-Thüringen and Frankfurter Sparkasse and several individual users within financial services. We are in the middle of finalising CARA based on the valuable feedback from our test users. Therefore, we are very excited to go live in May this year.

LTB: What is unique about CARA?

Pascal Di Prima: CARA is the first of its kind. Legal research tools are very rarely using a visual approach. We provide an alternative approach to the CRR. CARA makes the regulation much more accessible for professionals who are not working with the CRR on a daily basis. However, with article level link to the official regulator publications and our pop-up definitions, CARA is also an expert-tool to make CRR research much more efficient.

LTB: What is the story behind Lexemo and CARA?

Pascal Di Prima: Well, after the financial crisis, banking regulation has been increased significantly, especially at the European level. The regulation became much more complex and very dynamic. In my past as a banking regulatory partner, I witnessed that the information gap between legal experts on one hand and the business professionals within the financial institutions on the other hand became bigger and bigger and there were no tools, which could bridge this gap. Another problem we identified was that legal knowledge sharing within the bank had to be improved to face the problems resulting from the complexity of banking regulation. With this in our mind, we founded Lexemo and did a lot of interviews with senior people within banks, covering both sides, business and legal. Based on this intel, the vision we had from the beginning and the invaluable professional experiences of my co-founders, we started working on CARA. So 14 months later, we are in the middle of the pilot phase and the launch date is already in sight.

LTB: What is the pricing model?

Pascal Di Prima: CARA is a subscription based SaaS-tool with a very low entrance barrier of EUR 299.- per annum for Single Users and very attractive pricing models for teams. We also offer an enterprise version, where institutions can fully include their own internal policies and procedures within CARA.

LTB: What have you learned from early versions of CARA?

Pascal Di Prima: The most challenging parts within the product development process was the visual navigation and the search functionality. With respect to the navigation, we wanted to create a user interface, which is intuitive and fast to use with quick access to the relevant part of the regulation, and at the same time provide guidance for a professional, who is not an expert in the CRR. I think we’ve achieved that. Obviously search functionality is key to an information tool like CARA. With our approach to provide an intelligent search with filter functions for our users, we are on the right track. The integration of external context completes the search functionality and will exponentially increase its power.

LTB: What do you see are the principal risks to Lexemo?

Pascal Di Prima: The main risks for Lexemo are opportunities at the same time. Banking regulation is one of the most dynamic fields in European law, with new publications weekly and the CRR II on the doorstep in 2019. Keeping up to speed with this dynamic is also challenging for us as service provider. However, I believe that our technology approach is the only way to keep up with this speed.

LTB: What are your short-term targets? Which are the long-raging goals?

Pascal Di Prima: In the short-term, we want to finalise and launch CARA in May this year. But we are already planning to produce additional tools like CARA, for example we are currently looking into the General Data Protection Regulation (GDPR), which will be applicable as from 25 May 2018. In the long-term, we want to provide the alternative way to approach regulation. We believe that our visual approach can generally be applied to any kind of law or legal provisions.